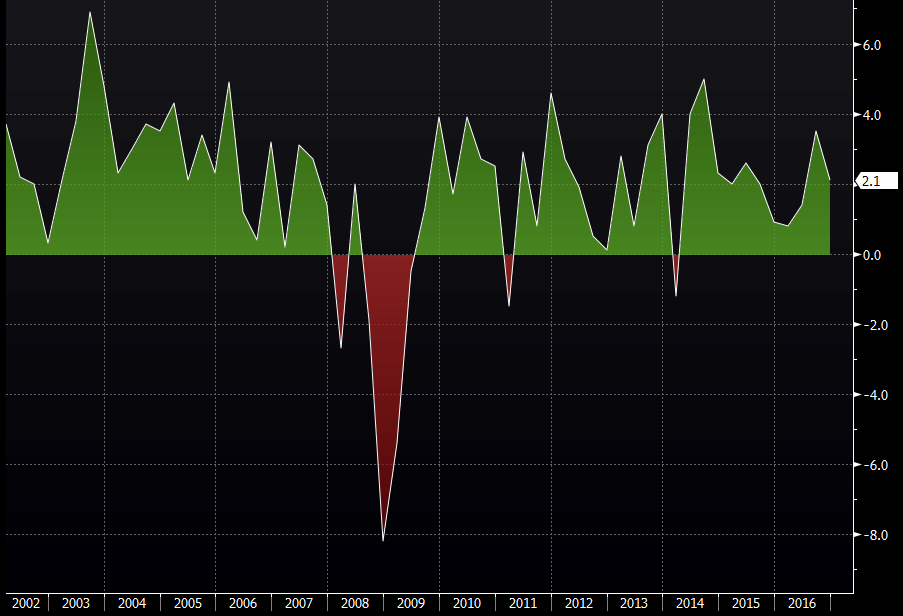

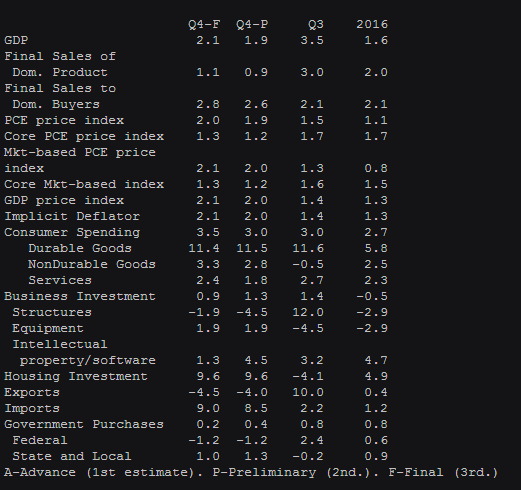

- Prior revision 1.9%. Flash 1.9%. Q3 3.5%

- Consumer spending 3.5% vs 3.0% exp. Prior 3.0%

- Sales 1.1% vs 1.0% exp. Prior 0.9%

- PCE 2.0% vs 2.1% exp. Prior 1.9%

- Core PCE 1.3% vs 1.2% exp. Prior 1.2%

- GDP deflator 2.1% vs 2.0% exp. Prior 2.0%

- Q4 corp profits 2.3% vs 6.7% prior

- Exports -4.5% vs -4.0% prior. Q3 10.0%

- Imports 9.0% vs 8.5% prior. Q3 2.2%

Consumer spending is probably the standout number, and one the Fed will take a lot of positives from. If there's a downside, it was from business investment which was revised down to 0.9% vs 1.3% prior.

No comments:

Post a Comment