WSJ Fedwatcher writes that the soft non-farm payrolls report will give the FOMC 'serious pause' about moving rates in June.

The

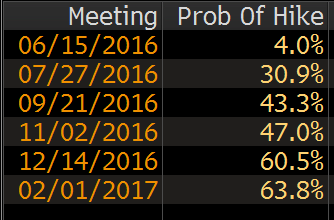

Fed funds futures market has obliterated the chance of a June hike,

knocking it down to 4% from around 30% before the report.

The market has quickly soured on July as well and it's at 30.9% compared to 54% last Friday.

A chart of the July implied probabilities shows the jump starting with the hawkish FOMC minutes and the drop since.

Janet Yellen will speak at 12:30 pm ET on Monday on the economy and

will likely offer a signal on the post-NFP Fed thinking. Many now expect

her to punt and for the Fed to wait for the June jobs report before

swaying markets. However, she may make an effort to keep July in play.

No comments:

Post a Comment