1) Watch the clock

The FOMC decision is out at 2 pm ET (1900 GMT). At the same time, the Fed releases the dot plot and its new round of economic projections. Roughly 30 minutes later, Janet Yellen hosts a press conference.2) The dot dance

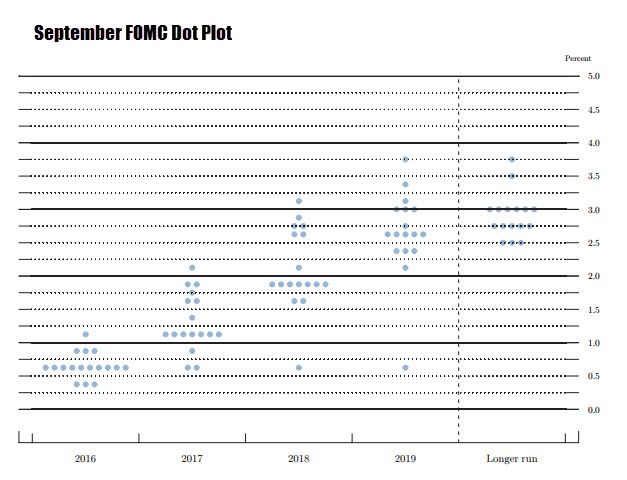

Where the dots are located doesn't matter. The Fed has been higher than the market since the inception of the dot plot and has always been wrong. What matters is the movement in the overall plot. If the blue dots generally move higher, it's a hawkish signal. If they stay where they were in September, that will be USD negative.3) Inflation forecasts are more important than growth

The Fed is likely to revise growth higher but it won't matter if inflation doesn't move up as well. The median PCE inflation forecast for 2017 is 1.9% and it rises to 2.0% in 2018.Even if that doesn't go higher, it's not necessarily negative for the US dollar. Watch how it relates to the Fed funds projected rate. Those two forecasts work in tandem so if Fed members anticipate higher rates, it means that rates had to go up to restrain inflation.

4) Sell the fact

This is one of the most-anticipated Fed hikes in memory. It's fully priced in with an 8% chance of a 50 bps surprise. The dollar has been steadily climbing in anticipation and USD/JPY is even strengthening in the countdown. The hike is coming, but it will also take some hawkish rhetoric to keep it afloat. That might be more than the Fed is willing to pre-commit to.5) The rush to judgement

The initial market reaction to the Fed is usually the wrong one. What's more is that roughly minutes before Yellen begins to speak, the market often retraces a good portion of any knee jerk.Subtle changes in rhetoric are often overblow in trader's minds on Fed day. When the dust settles, the market tends to retrace. It's not the FOMC that's driving markets at the moment. Speaking of that...

No comments:

Post a Comment