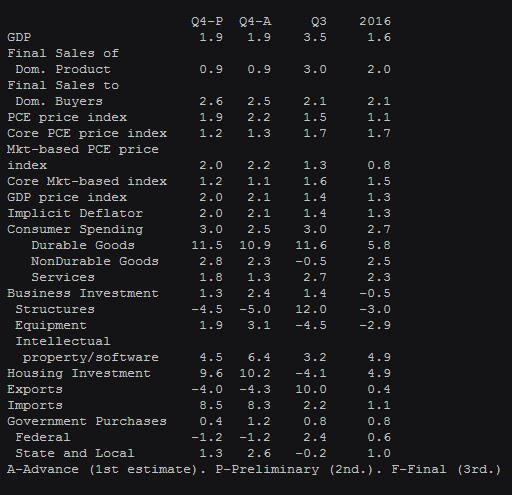

- Flash 1.9%. Q3 3.5%

- Consumer spending 3.0% vs 2.6% exp. Flash 2.5%

- PCE 1.9% vs 2.2% exp. Flash 2.2%

- Core PCE 1.2% vs 1.3% exp. Flash 1.3%

Prelim sales 0.9% vs 1.0% exp. Prior 0.9%

GDP deflator 2.0% vs 2.1% exp. Prior 2.1%

Exports -4.0% v s-4.3% prior

Imports 8.5% vs 8.3% prior

Business and housing investment was lower, lower investment in structure led the fall on the business side.

Consumer spending is the bright spot, with gains in all three sub-components.

Overall, there's disappointment here, as the market was expecting more than just matching the flash. We've had updated price data since all this so the focus will be on that more than this.

No comments:

Post a Comment