Americans are starting to pile up more credit card debt than ever before.

According

to a new study released Monday, U.S. consumers added $33 billion in

credit card debt during the second quarter of 2017, making it the

second-highest point of debt since the end of 2008.

Personal Finance website WalletHub.com—who

conducted the study—projects that by the end of 2017, Americans will

pile more than $60 billion in new credit card debt, which means overall

the U.S. is headed towards well over $1 trillion in credit card debt.

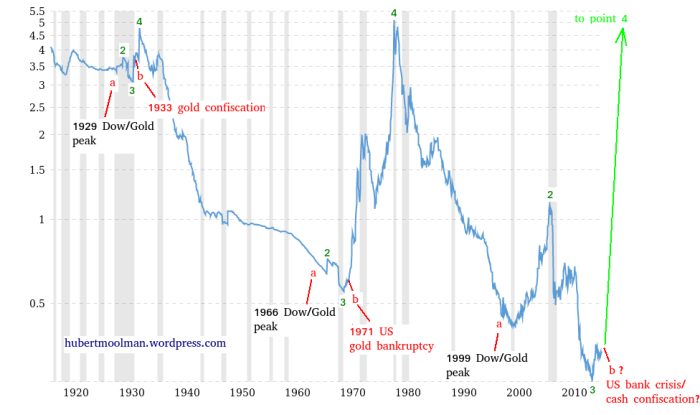

Hubert Moolman makes the case for a major banking crisis thats inevitable and likely to happen fairly soon. With extreme debt levels, many global central banks are close to failure.

Even though I have presented a few charts on the VIX – Volatility Index in past articles, I thought this one would provide a better picture of the coming disaster in the U.S. stock markets:

The VIX – Volatility Index (RED) is shown to be at its lowest level ever when compared to the S&P 500 Index (GREY) which is at its all-time high. If we take a look at the VIX Index in 2007, it fell to another extreme low right at the same time Bear Stearns stock price reached a new record high of $171. Isn’t that a neat coincidence?

As a reminder, the VIX Index measures the amount of fear in the markets. When the VIX Index is at a low, the market believes everything is A-OKAY. However, when the VIX surges higher, then it means that fear and panic have over-taken investment sentiment, as blood runs in the streets.

As the Fed and Central Banks continue playing the game of Monopoly with Trillions of Dollars of money printing and asset purchases, the party won’t last for long as DEATH comes to all highly leveraged garbage assets and Ponzi Schemes.

To get an idea just how much worse the situation has become than we realize, let’s take a look at the energy fundamental that is gutting everything in its path.

No comments:

Post a Comment