- Prior was 1.6% y/y

- Core +0.2% m/m vs +0.1% expected

- Prior core -0.1% m/m

- PCE deflator 1.7% vs 1.7% y/y expected

- Prior PCE deflator +1.8% y/y (revised to +1.9%)

- PCE deflator +0.2% vs +0.2% m/m expected

- Prior deflator -0.2% m/m

- Personal income +0.4% vs +0.4% expected

- Prior personal income +0.2% (no revision)

- Personal spending +0.4% vs +0.4% expected

- Prior personal spending 0.0% (revised to +0.3%)

- Real personal spending +0.2% vs +0.2% expected

- Prior real personal spending +0.3% (revised to +0.5%)

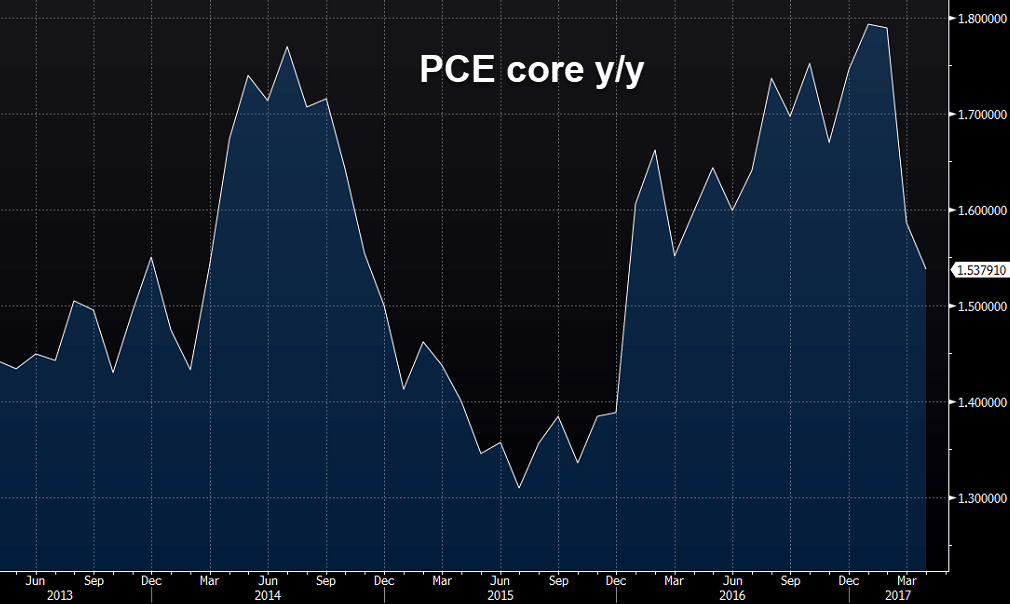

Digging deeper into the numbers, core PCE y/y was +1.538% unrounded so that's a good sign.

What's a bit troubling is that all the inflation is coming from services, durable goods are highly deflationary.

- Goods +0.3% y/y

- Durable goods -2.7% y/y

- Non-durable goods +1.9% y/y

- Services +2.4%

No comments:

Post a Comment